|

||||||||

|

Bank

crisis? Reform! Netherlands

below or |

|||||||

|

||||||||

|

|

Bank

crisis? Reform! Netherlands Abstract:

This article describes an idea for a bank reform, with which the enterprises are protected against the antics in the banking world and which enables better economic policy, also in hard times.

Inroduction There are many analyses about the causes of the bank crisis. Many explain it like a consequence of greed, insuffiscient regulations and failing control by central banks. Governments were completely surprised when the banks started to fall and they were suddenly confronted with the consequences. Ministers of Finance got carte blanche to get the banks back on track with billions of euros of support. All this because they are so important to the economy. But the billions of euros disappeared like cans of oil in a leaking gearbox. The cog-wheels did not want to start moving. Meanwhile more and more enterprises fail from the lack of credit. Entire countries are getting in trouble and fall in the tutelage to the International Monetary Funds. [1] Some analists forecast, that the crisis could last for some years... And, as if unrelated, the continuing growth disturbs the climat. Our rules and values are dictated by consumption and greed. And ever more public services are sacrificed at the altar of Wall Street... There is an alternative. Governments can take over the supply of credit. When money becomes state money, we don't need to depend any longer on the solvency / liquidity mechanism of private banks, that can get stuck again, any time, if, somewhere in the world, rotten securities are circulated. In today's international, speculating and bubbling jungle of profiteering, you may be rather sure the next crisis is in the making somewhere already. I think it is nonsense to let the enterprises fail because of incidents in the banking world. I think it is shortsighted to rescue private banks with billions of tax money, buying them or supplying liquidity and guarantees. Sure, when the state helps these banks, the banks must pay back with high interest. Fine. But this simply means, that the banks will pass on these costs to you and me as their customers. One way or the other we are screwed! This article describes an idea for a bank reform with the following objectives: - end the crisis; - money creation / credit supply based on economic and social interests; - prevent credit supply from drying up by incidents in the banking world; - prevent conflicting policy between goverment and central bank; - set up parlementarian control over money creation; - give the central bank, in addition to the existing acceleration and break pedal, a steering wheel; - unbind the credit supply from economic growth; - guarantee the best possibilities for prosperity, also during worse times.

1. Today's credit supplyCentral bank is independent At the moment nearly all central banks are independent from governments. Banks and central banks determine how much credit is supplied and how much the users of the money must pay for it. The central bank influences the economy. In the words of the Dutch central bank (DNB N.V.): "The interest functions as the acceleration and break pedal of the economy." [2] Two captains on one ship Most countries now have an economy with two captains. the policy of the central bank determines the room for action of the government. When the govenment wants to stimulate the economy, while the central bank keeps the interest rate high, the government won't have much success. Money multiplier

2. Short look backBefore the establishment of central banks bankruptcies were the greatest barrier to the growth of the banking sector. In 1913 the Federal Reserve was set up. This private institution would keep a reserve of the banks, with which banks in troubles could be rescued. This way, affiliated banks could lend out more money, while the "trust" of the public was increased. The Fed obtained independency from the government. Politicians did not have a clue about what money was and the bankers promised to take care of it.

The role of central banks evolved over time and differed from one country to another. In some instances they were financiers of wars, at other times they were stimulators of agriculture or industry. Most of the times they were regulators of the banking sector and later they also intervened in the payments between banks. With the interest rate they influence the exchange rate, the economic activity, the inflation and the benefit margin of banks. Meanwhile, the banking world has grown into a badly arranged international, financial jungle, in which social and business interests are sacrified to the laws of greed and the expanding money mass. In this regard, many central banks have followed a policy of laisser-faire.

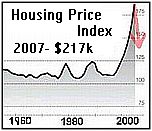

3. Short look aheadSo, for the coming years a recession has been predicted, that, in my opinion, is unnecessary, if the government takes up the responsibility for the credit supply. Foreign debt US

When this happens, countries will only be able to limit its consequences, when their credit supply is in hands of the government, that won't have to be guided by shortsighted profiteering and hungry stock holders. Forecast energy A more serious problem is the forecast of a decreasing availability of energy. (See "World Energy and Population�.) We all know we are consuming finite energy sources. For generations we have become used to consume these reserves at a faster pace all the time. We were sure, that after that, other energy sources would be found... Most of us spontaneously prefer to deny that the end of growth is at the door. This denial is not so much about the the fact that the available data would not be reliable. Many people simply cannot imagine the world otherwise as with growing populations and economies. There are also people, who still confuse energy "reserves" and energy "supply". And we like to fool ourselves with our production of sun and wind energy, that, in fact, amounts to only 1 percent of world's energy consumption. So, amazingly, we just act as if the problem does not exist.

4. Bank reformThe credit supply must become independent of the faith that the public has in the banks. To put it in an other way, the credit supply must become independent of the deposit and savings balances. The credit supply should not depend on a banking mechanism, that can easily get stuck when an incident disturbs the liquidity and solvency of some banks. The credit supply must also be able to function normally in times when there is no economic growth and the population is shrinking. [3] I see the solution in a bank reform, in which today's central bank is replaced by a central bank of the government, who, as sole issuer of money, will take up the responsible for the credit supply. The credit supply based on solvency and liquidity of private banks will be abolished and with that the multiplication of fictive money. [4]

Banks will become the serving counter between the central bank and the public. The central bank can then steer the money mass and the value of the currency-unit precisely. Today's central bank uses one interest rate as acceleration and break pedal of the economy, as if all sectors of the economy must always be stimulated or slowed down in an equal way. This leads to many unwanted side effects. This crude way can be refined by setting up interest rates by sector. This way the central bank not only has an acceleration and a break pedal, but also a steering wheel. Economic policy can be implemented in a targeted, more precise way. The guide should not be the biggest and fastest benefits, but the quality of the society and the needs for the future. In times of economic prosperity it is usual that parlementarians don't look much further than the length of their term. However, we put children on the world for 75 or 80 years. Therefore, it would be more logical, that - at least - we evaluate, if there will be enough energy, food and water for the coming 75 years.

Because today's system is based on the permanent growth of the money supply, when the economic input and output decrease, more and more bubbles of money without real value appear, which will collapse sooner or later. By centralizing the credit supply and making it independent from economic growth, it will be possible to steer the economy and keep the best possible prosperity, even in times of economic down turn.

One way is look ahead and use our brains. If there will not be enough energy and food in the future, we must put less children on the world. The less children there are, the better the possibilities will be for a high quality of life.

A few practical points The privileges of central banks sit on articles of law. Changing articles of law is a matter for parliament. Many members of parliament probably don't have the slightest idea about what money is and how it works. I hope that "Secrets of money, interest and inflation" and "Debit, credit, banco!" form a short and clear introduction. Nearly all available economic books are about the growth economy. That makes it a bit more difficult to get insight. Because of the theories of the growth economy, many people confuse economic growth and prosperity. Starting up a central bank of the government is not an expensive matter. Money is just a "debt with collateral" and can be created out of nothing, like most existing money today. [7] The "nationalization" of central banks doesn't have to be expensive either. In its most simple form it consists in withdrawing privileges. The employees could receive a proposition to come and work for the new central bank of the government. Banks will remain necessary as middlemen between the central bank and the public. The criteria for the credit supply are determined by economic policy and its execution by the central bank. Today's criteria of profiteering, liquidity and solvency of individual private banks will no longer determine the supply (or not) of loans. For the public not much will change. People can keep their bank accounts. However, I think, in the future more and more people will choose more consciously for co-financing useful projects. The euro The euro is the currency of the European Central bank in Frankfurt. This is a private institution, composed of the private central banks from the affiliated countries. The ECB and these central banks are independent. [8] The euro is not an obligation for the European Union. For instance, the Bank of England is a nationalized bank with its own currency. By itself, a common currency in the European Union is a pleasant thing. However, the enormeous power of the bank consortium ECB forms a threat and a hollowing of the democarcy. The unbridled creation of money already led to the sale of most public tasks like post, telegraph, telephone, public transport, gas, water and electricity supply, police and prison tasks. The population is at the mercy of the big money. The room for action of the governments is more and more reduced. I don't think, that the ECB will be inclined to give up its power. A new European currency should be created by governments that share a vision about the shape of society now and in the future. Fo this, any country of the European Union could take the initiative.

[1] Iceland, Hungary and Ukraine http://uk.reuters.com/article/marketsNewsUS/idUKLJ43131520090119

[2] Interest is the accelleration and the break pedal (De Nederlandse Bank N.V.) http://www.dnb.nl/en/interest-rates-and-inflation/general/index.jsp

[3] � World population and energy �, graphic 14 http://www.courtfool.info/en_World_Energy_and_Population.htm

[4] Money multiplier; � Debet, credit, banco ! � http://www.courtfool.info/en_Debit_credit_banco.htm

[5] Central banks promote the permanent inflation (pretended 2%) as "Price stability" ! http://www.ecb.europa.eu/home/pdf/students/leaflet_en.pdf , page 10

[6] "World Energy And Population", Paul Chefurka http://www.courtfool.info/en_World_Energy_and_Population.htm

[7] Until 1971 the US-dollar was backed by a quantity of gold. Backing money with the value of precious metals not only has the disadvantage of possible speculations, but also means that foreign suppliers of these minerals automatically become owners of the represented value. Fiat money, on the contrary, sits on recognition of debt, the promise of a service in return. Because it is created out of nothing, the danger of abuse by financial authorities (for instance inflation) is higher.

[8] ECB follows its own policy http://www.ecb.europa.eu/ecb/orga/independence/html/index.en.html 4 February 2009

For reactions and reply you can contact the author via www.courtfool.info . If you wish, you may copy this article and forward it or publish it in newspapers and on websites. Whenever possible, please mention a link to www.courtfool.info/en_Bank_crisis_Reform.htm Should more people read this article? On the internet the readers have the power! They decide which information goes around the globe! You may not be aware of it, but if each reader sends a link to 3 other interested persons, it only takes 20 steps to join 3,486,784,401 people! You want to see it happen? Use your power! 3 x 3 x 3 x 3 x 3 x 3 x 3 x 3 x 3 x 3 x 3 x 3 x 3 x 3 x 3 x 3 x 3 x 3 x 3 x 3 = 3,486,784,401

|