|

||||||||||||||||||||||||||

| December 14-15, 2010 -- Obama's CIA brief: infiltrate the Marxist Left and "de-communize" it |

| It is apparent that one of Barack Obama, Jr's

major tasks for the CIA, through his work with

Business International Corporation, his membership

in leftist student groups at Occidental College in

Los Angeles and Columbia University in New York, and

his work as a "community organizer" in south Chicago

was to infiltrate and "de-communize" the Marxist

left and bring it into the capitalist globalist

fold.

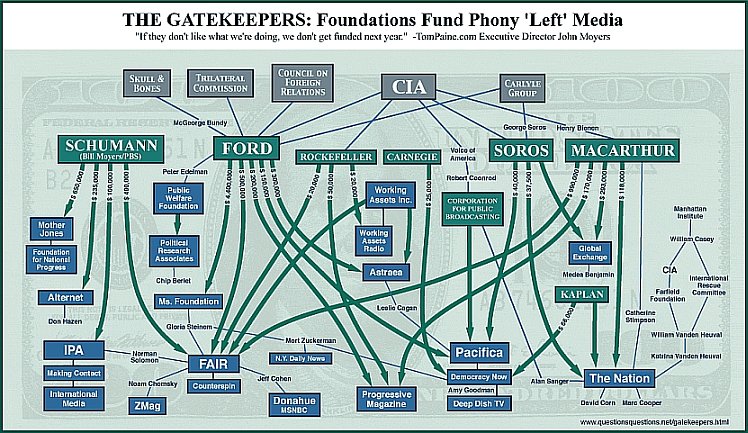

Obama's work complemented that of his mother, alleged Kenyan father, and grandfather in peddling the CIA's influence to leftist nationalists in newly-independent nations in what was once known as the "Third World." The goal of the CIA's infiltration of leftist movements through Obama's post-Columbia "leftist outreach" employer, Business International Corporation (BIC) was to carry out the tactics championed by former Office of Strategic Services (OSS) and CIA officer Herbert Marcuse, a German-born Jew and self-proclaimed "Hegelian" and "Marxist." Marcuse's agenda included what Yuri Zhukov wrote in Pravda on May 30, 1968: "radical and global negation of all the elements constituting [the industrial socialist society], including Communist Parties." Marcuse, as Zhukov wrote, sought to "cast doubt on the chief role of the working class in the struggle for progress, democracy, and socialism." Obama's "liberal" policies have succeeded in destroying the progressive left in the United States, including the labor union movement and the social security and welfare programs instituted by the Franklin Roosevelt, Harry Truman, John F. Kennedy, and Lyndon Johnson administrations. Obama was groomed by the CIA to do what no Republican or conservative politician could ever do: destroy the American middle class and the American social safety net -- and accomplish these deeds from a contrived "leftist" position. Obama has accomplished his task. Obama's "radical" campus activities mirror those of University of Paris sixties student radical Daniel Cohn-Bendit, who led "Maoist" and "Trotskyite" student riots while on a stipend from the West German government. Cohn-Bendit's activities on behalf of the CIA and the French extreme right were revealed by French General Confederation of Labor Benoit Franchon on May 27, 1968, while addressing workers at a Renault automobile plant, "Right now, a whole cohort of people do nothing but 'feed the fires,' showering all kinds of praise on the young people's enthusiasm, while actually they are preparing a trap and a snare for us." One of the CIA tasks of the French student protesters in Paris in 1968 was the derailing of the Paris peace talks between the United States and North Vietnam. The leftist "fifth columnists" were, thus, responsible for continuing the Indochina war well into the Nixon administration. Just as with his his French "radical" for-bearers, Obama came into office on a wave of American anti-war feelings and then not only continued the U.S. military presence in Iraq but boosted it in Afghanistan and Yemen. Obama's membership in a Marxist Club at Occidental, one of the CIA's favorite campuses for recruiting agents, fit a pattern of CIA meddling in student organizations, particularly leftist ones like Students for a Democratic Society and the National Students' Association, across the nation. Obama's alma mater, Columbia, has a long association with U.S. intelligence that even predates the CIA. The Russian Institute of Columbia University was the brainchild of Professor Gerold T. Robinson in 1944 while he was on loan from Columbia to the OSS. The institute later trained many Slavic language linguists for the CIA's Radio Free Europe and U.S. Air Force personnel who flew signals intelligence missions against the USSR, Hungary, and Albania. Columbia also excelled in training CIA operatives for Ann Dunham-type agricultural "field work" in South Vietnam, Thailand, Bolivia, and Guatemala -- all targets for CIA anti-Communist activities. In 1967, the year Obama's mother whisked him off to post-coup Indonesia, the CIA was revealed to have had several U.S. college students studying abroad on summer studies programs acting as agents. The Independent Research Foundation, co-founded by "leftist" feminist Gloria Steinem, was revealed to have been a CIA front tasked with attending World Youth Festivals and compiling dossiers on attendees. Columbia's School of International Affairs (SIA) conducted detailed studies of socialist countries, including the USSR, that were extremely similar to those produced by BIA. Columbia also maintained close links with the Pentagon and the National Security Agency through its support for the Institute for Defense Analysis (IDA). Obama's "faux" journalism work for BIC was authorized by both the CIA and the company's management. Before the post-Watergate restrictions on CIA activities, CIA agents were able to recruit journalists, usually "stringers," without Langley's approval. That changed after the Frank Church and Otis Pike congressional hearings. Somewhere in the bowels of Langley may be CIA-BIC agreements on the use of BIC personnel as CIA assets or agents. And those files may contain the name or names "Barry Obama," "Barry Soetoro," "Barack Obama," or "Barack Sutoro." Obama's other alma mater, Harvard, also maintained close ties with the CIA. The FBI also had a penchant for hiring informers in liberal and black communities like south Chicago. Informers were screened in files known as PSIs and PRIs: potential security informant and potential racial informant and were paid a stipend. After being approved, PSIs and PRIs became "reliable informants" and were assigned a cover name, an informant number, and a regular salary. A scan of the FBI's files for anyone of Obama's appellations during his time in south Chicago may reveal one or more of such informant files. The Rockefeller family was fond of funding a number of left-wing organizations. Groups devoted to the anti-nuclear movement were linked to the Rockefeller Family Fund-supported Corporate Data Exchange. Inc. (CDE), a BIC-like "research organization" albeit a tax-exempt one, founded in 1975 to "investigate economic decentralization and corporate control," according to an April 21, 1983, article in the Pittsburgh Tribune-Reviewtitled "Foundations Bankrolling Anti-Nuclear Causes." Three of the CDE's founders were associated with intelligence-gathering for the North American Congress on Latin America (NACLA), a progressive organization that is ostensibly opposed to U.S. interventionism in Latin America. The CIA archives contain an undated paper titled "The Agency and the Young Employee," that describes the CIA's outreach to young people: "The young Agency employee or potential employee shares common experiences with his counterparts in the sub-culture and, although he may not have been in most instances an active participant in this counter-culture, he has been in close touch with it and its views." The tract continues, ""menial work -- until he 'knows the business' -- is anathema and is met with derision. He similarly views long periods of training, job orientation, and job rotation as wasteful of his time . . . The CIA is just beginning to see the influx of the new generation . . . They can be a great asset to the present and future of CIA." Indeed, with Barack Hussein Obama, Jr., he was a great asset and continues to be one for the CIA.

|

|

| Tales from the Obama Crypt (Obama maternal grandparents) |

| April 5-6, 2011 -- Tales from the Obama Crypt

WMR has spoken to a number of individuals familiar with Barack Obama, Jr. at Harvard and in the city of Chicago. Combined, these individuals who researched Obama during his early lawyer and politician years are painting a very different portrait of Obama and his mother and maternal grandparents. In fact, and as WMR previously reported, Obama's mother, Stanley Ann Dunham and maternal grandfather, Stanley Armour Dunham, both were affiliated with the Central Intelligence Agency. We have also reported on Obama's maternal grandmother, Madelyn Dunham, and her link to CIA money laundering accounts at the Bank of Hawaii in Honolulu. However, it is now evident, from information gleaned from African-American associates of Obama's in Chicago in the mid-1980s, that Stanley Armour and Madelyn Dunham, like their daughter Stanley Ann Dunham, have fabricated personal histories. From an African-American political activist in Chicago who knows President Obama, we have learned that Obama's mother was not born in Wichita, Kansas but was born in Beirut, Lebanon while her parents were serving with the wartime Office of Strategic Services (OSS), the forerunner to the CIA. Ann Dunham's birth date is reported to have been November 29, 1942. This was during the time after which Lebanon's Vichy-led government collapsed --July 14, 1941 -- and when the leader of the Free French, General Charles de Gaulle, proclaimed Lebanon nominally independent. After Lebanon's nominal independence was declared on November 26, 1941, the United States opened an embassy in Beirut at ambassadorial level. Soon, the U.S. embassy in Beirut became one of the top OSS listening in the Middle East and U.S. Army personnel, seconded to the OSS, arrived in the city. Stanley Armour Dunham reportedly enlisted in the U.S. Army on January 18, 1942, a few months after Lebanon's nominal independence was granted under French domination. It is not certain when Mr. Dunham actually joined the Army because his service records in the military have been curiously sealed. It has been reported that Dunham served in England with the 1830th Ordnance Supply and Maintenance Company, Aviation in support of the 9th Air Force in the lead up to the June 6, 1944 Allied invasion of Normandy. However, from 1942 to 1944, little is known of Dunham's military service. Dunham's wife, who supposedly worked at a Boeing B-29 assembly plant in the Dunhams' hometown of Wichita, reportedly gave birth to Stanley Ann Dunham on November 29, 1942. However, we have now learned that Mrs. Dunham was, in fact, posted to Beirut with her OSS husband in 1942 when she gave birth to Obama's mother. The Dunhams would not have been the only couple working together for the OSS. Famed chef Julia Child met her husband Paul Child during their joint service for the OSS during World War II. Julia Child served in Ceylon and China during the war and she met Paul during her OSS service abroad. They married in 1946. Before joining the OSS, Julia Child worked for a furniture store in New York City, W. & J. Sloane. The fascination of retail store people for OSS, and later, CIA work is uncanny. One of the OSS's and Britain's Secret Intelligence Service's (SIS) top "archaeologist" spies in Peru, Cuba, and Chile during World War II was William J. Clothier II, grandson of the co-founder of the Strawbridge & Clothier Department Store chain based in Philadelphia. Another archaeologist who was a spy for the United States in both World Wars I and II was Samuel Lothrop, who, according to David H. Price in his book "Anthropological Intelligence: The Deployment and Neglect of American Anthropology in the Second World War," was not only from a wealthy New England family but was friends with New York socialite and one of Franklin Roosevelt's intelligence advisers, Vincent Astor. Lothrop was kin to Alvin Lothrop of Chelsea, Massachusetts, who, with Samuel Woodward founded the Woodward and Lothrop department store chain in Washington, DC. Nor would anthropologist spies been unknown to the Dunhams in Beirut. According to Price in his book, one of the OSS's leading anthropologist spies, Derwood Lockard, served in Beirut toward the end of World War II after having served in Kenya from 1943 to 1944. Stanley Armour Dunham supposedly was discharged from the Army on August 30, 1945, but because his military records are sealed, this cannot be verified. In the post-war years, the Dunhams were said to have moved to Berkeley, California; Ponca City, Oklahoma; Vernon, Texas; El Dorado, Kansas; and Mercer Island in Seattle, Washington before moving to Honolulu, Hawaii in 1960. Stanley Armour Dunham, according to what is now appears to be a biography concocted by the CIA, for whom Dunham began working for in 1947 after the transition from the OSS. Mr. Dunham supposedly worked for a chain of furniture stores. Not much is known about the Dunhams' daughter, Stanley Ann, until she was enrolled in Mercer Island High School in 1956. However, if the Dunhams were stationed in Beirut up until the time Stanley Ann Dunham was enrolled in Mercer Island High School in 1956, all the furniture store jobs held down by Stanley Armour and all the restaurant waitress jobs held by his wife were clever ruses devised by the CIA to mask their actual war-time work in the Middle East. From Oklahoma to Washington state and finally to Hawaii, Stanley Dunham reportedly worked for four furniture stores: J. G. Paris in Ponca City, Doces Majestic and Standard-Grunbaum in Seattle, and Pratt Furniture in Honolulu. There is no documentation to show that Pratt in Honolulu existed beyond a Hawaii-registered shell company. In addition, Madelyn Dunham's wartime OSS work with her husband in Lebanon would explain why she became one of the first female vice presidents at the Bank of Hawaii in Honolulu and was trusted to handle the escrow accounts used to bribe CIA-financed leaders in Indonesia, South Korea, Taiwan, Japan, and the Philippines. Madelyn was enrolled at the University of Washington before moving to Hawaii but she never obtained her degree. Evacuating Madelyn Dunham and her daughter from Lebanon in 1956 would have made sense for the CIA. In 1956, what had been a peaceful country conducive to a CIA family posting became embroiled in conflict between the Christian Maronite President Camille Chamoun on one side and Sunni Muslim Lebanese Prime Minister Rashid Karami and Egypt's President Gamal Abdel Nasser on the other side. The UK, French, and Israeli invasion of Suez, although not supported by President Dwight Eisenhower, caused problems for the Americans in Lebanon. The pro-U.S. Chamoun was accused by Karami and Nasser of not taking stronger action against London and Paris, including severing diplomatic relations, for their attack on Egypt. The creation of the United Arab Republic (UAR) by Egypt and Syria in 1958, the calls by Lebanese Sunnis for Lebanese accession to the UAR, and the overthrow of the Hashemite monarchy in Iraq the same year, promoted Eisenhower to land U.S. Marines in Lebanon in 1958 in response to a request from Chamoun. By that time, the Dunham mother and daughter had been safely inserted into Mercer Island, which had a heavy concentration of CIA and Pentagon personnel. It is quite possible that Stanley Armor Dunham's "furniture store" cover in Seattle was used to mask his actual continued work in Lebanon for Eisenhower's OPERATION BLUE BAT Marine landing in Beirut.

There is a photographic clue as to the Dunhams presence in Beirut in the early to mid 1950s. In the photograph above, a ten- or elevem-year old Stanley Ann Dunham (left) is wearing a sash with the stylized abbreviation "NdJ" on the sash of her school uniform. WMR has had it confirmed by African-Americans in Chicago who knew Obama that the abbreviation stands for "Notre-Dame de Jamhour," a private Catholic school in Beirut, which, as WMR previously reported, "NdJ was a male-only school until 1975 but there is also information that NdJ has had a sponsorship arrangement with Catholic educational institutions in Lyon, France." As with his mother and maternal grandparents, there are huge holes in the history of President Obama. Although it has been previously reported that his academic records from Occidental and Columbia remain sealed, there are facets of Obama's time at Harvard Law School. Obama was elected the first black president of the Harvard Law Review in 1990. Although Obama was quotedin The New York Times, at the time, saying, "The fact that I've been elected shows a lot of progress . . . It's encouraging . . . But it's important tat stories like mine aren't used to say that everything is O.K. for blacks. You have to remember that for every one of me, there are hundreds or thousands of black students with at least equal talent who don't get a chance." However, according to an African-American contemporary of Obama at Harvard in 1988, two years before Obama's election to head the Harvard Law Review, there was another painted of Obama. Our source happened to hear a speech by an unknown law school student on campus who was railing against black student activism on campus, cautioning those present that such activism was counter-productive. Our source listened intently to the student's speech and turned to a colleague and inquired, "who is that mulatto up there speaking against our interests?" The answer from the other student was, "That's Barry Obama." The last name was pronounced by some Harvard African-American students as "O-Bama," as in "ALA-bama," a reference to Obama's conservative views that accommodated white faculty and students on campus. Our source did opine tohis colleague at the time, "that mulatto is going places with that attitude." |

| Michael Scott |

| November 17, 2009 -- There's a political ill

wind blowing for Obama in Chicago

A long-serving member of the Chicago Police Department who now tracks corruption in city politics told WMR that the last-minute trip by President Barack Obama to Copenhagen on October 2 to appeal to the International Olympic Committee (IOC) was part of a strategy hatched by Obama's Chicago real estate friends and contributors to cash in on profits on speculative real estate investments had Chicago secured the 2016 Summer Olympics. Instead, the IOC awarded the Summer games to Brazil. Our Chicago source revealed that Valerie Jarrett, the director of the White House Office of Public Liaison that works with state and local governments, was a key player in the deal to bring the 2016 games to Chicago. Jarrett's firm, Habitat, Inc., WMR was told, played a key part in the Chicago Olympic development scheme. Jarrett had served as Vice Chairman of Chicago 2016, the non-profit organization established to lure the games to the city, and she worked closely with Michael Scott. A key member of Mayor Richard Daley's Olympic committee, real estate developer Scott, who was also President of the Chicago Board of Education and a confidante of the Chicago school system's former CEO, Arne Duncan, President Obama's friend and current Education Secretary, was found dead in the early morning of November 16. Scott's body was found in the Chicago River and the Chicago medical examiner reported Scott died from a self-inflicted gun shot wound to the head. Scott owned Michael Scott & Associates, a real estate development and investment firm. Scott and his firm stood to make a fortune in the sale of land in Chicago's Douglas Park had Chicago been awarded the 2016 games. Scott also teamed up with Chicago real estate developer Gerald Fogelson in 2002 to form FS Associates LLC to develop Chicago West Side properties. Scott and Fogelson were eyeing the multi-billion Olympic Village project. Fogelson, through Fogelson Companies, Inc. and Jersen Investments, LLC, was a major contributor to Democratic candidates, including presidential candidate Barack Obama. Jarrett served as Chair of the Chicago Transit Board from 1995 to 2005 and also had inside knowledge of public and private land since the Transit Board was a major player in acquiring land for transit projects. Our Chicago source pinpoints Jarrett as the key player in the Olympic land grab deal, along with senior members of the Daley adminisration and Michelle Obama, the First Lady. This past September, Chicago constructor and top fundraiser for impeached Illinois Governor Rod Blagojevich, Christoper Kelly, was found dead from apparently overdosing on a pain killer. Kelly, who was involved in construction projects at O'Hare International Airport, pleaded guilty to federal fraud counts. O'Hare's expansion was part of the incentive package used by Chicago to lure the 2016 Olympic games to the city. WMR has been told that there are "smoking gun" documents dealing with Habitat Inc.'s involvement with the Chicago Olympic bid and we are trying to obtain them.

|

| WMR White House battles U.S. intelligence factions via WikiLeaks and Anonymous March 12-13, 2012 |

| The Obama White House is running a covert

operation that is using authorized leaks of

information through groups such as WikiLeaks and

Anonymous to battle against other parts of the U.S.

intelligence community that are resisting Obama

efforts to engage in massive warfare in cyber-space,

according to well-placed Pentagon insiders.

Using the assets of the U.S. Cyber Command, headed by General Keith Alexander and continuing warrantless wiretapping authorities carried over from the Bush administration, a covert group of White House conspirators working under the direction of White House Office of Information Regulatory Affairs (OIRA) chief Cass Sunstein and National Security Council adviser Samantha Power, Sunstein's wife, cyber-hackers have gained access to various computer networks and released information damaging to White House enemies in the intelligence community. The most recent target of such activity was the private intelligence firm Stratfor, an Austin, Texas-based company that is close to Republicans and employs a number of former CIA and military intelligence personnel. While the White House has actively engaged in indicting and punishing government whistleblowers who have contacted the media, the OIRA-led group has been responsible for leaking volumes of data to the media, using WikiLeaks and members of the hacker group as go-betweens. Although the Justice Department is trying Army Private First Class Bradley Manning and is seeking the extradition of Australian WikiLeaks co-founder Julian Assange, the White House and State Department have admitted that none of the State Department cables, the highest classified as "Secret," released through WikiLeaks were damaging to U.S. national security. However, Manning and Assange were unwitting pawns in high-stakes warfare between the Obama White House and its accomplices the U.S. intelligence community, including Alexander and CIA director David Petraeus. U.S. government infiltration of activist groups Two low-level operatives of the White House operation have already been identified as working as confidential informants for the FBI. Adrien Lamo helped to lure Manning into his web in order to provide the covert White House team with a "patsy" to ensure "plausible deniability" of White House involvement in the State Department cable release. And more recently, Hector Monsegur, aka "Sabu," was identified as an FBI informant within the ranks of the hacker group LulzSec, which is linked to the hacking activities of Anonymous. The entire covert White House operation is designed to advance cyber-space as a battleground in which to wage information warfare against various governments around the world with a view to undermining their credibility and causing them to fall as a result of U.S.-orchestrated street action and "themed" or "color" revolutions. It is known that there was resistance to such activities from career State Department foreign service officials, as well as current and retired CIA and Defense Intelligence agency personnel, some of whom work for Stratfor. The leak of some 250,000 State Department cables and 5 million Stratfor e-mails by the covert White House group was engineered to undermine members of the Foreign Service and older and retired members of the U.S. intelligence community who oppose the use of non-governmental organizations (NGOs) in actions that contributed to the ouster of regimes long-supported by the CIA and some senior U.S. diplomats, including those in Egypt, Tunisia, Libya, and Yemen. U.S. government-sponsored campaigns of opinion-shaping and disinformation The release by Invisible Children, an NGO with dubious motives, of the viral video about Ugandan warlord Joseph Kony and his long-time abuse of child soldiers, "Kony 2012," on YouTube, an act encouraged by the Sunstein/Power husband-wife team, is seen by State Department Africanists as a way to inject the already war-weary Pentagon into internal African civil warfare to the benefit of U.S. Africa Command (AFRICOM) clients in the region, including Ugandan dictator Yoweri Museveni, Kenyan Prime Minister Raila Odinga, and Rwandan dictator Paul Kagame. However, the White House team was sloppy in not thoroughly checking the content of the Stratfor emails. The push-back against the White House hacking and disinformation team can be seen in two Stratfor e-mails that mentions the operations of one of the members of the Sunstein/Power team, off-and-on State Department official Jared Cohen of Movements.org, one of the many organizations that are partly or fully funded by George Soros's Open Society Institute (OSI). Cohen is now the director of Google Ideas. In one email, dated February 11, 2011, Stratfor's Fred Burton refers to Cohen as a "loose cannon" who is using his Google position to engage in "regime change" through a "scorched earth" policy. Burton suggests that Israel's security agency Shabak pick Cohen up for an "interview" while entering Gaza after being involved in fomenting street protests in Tunisi8a and Egypt. The e-mail also says it was uncertain whether Cohen was acting on his own -- "driving without a license" -- or working on the "part of leftest [sic] fools inside the WH who are using him for their agendas." WMR has learned from Pentagon sources that Cohen was, in fact, acting on behalf of the Sunstein/Power group. In addition, we have learned that Cohen's operation was supported by Sarah Sewall, the founder of the Mass Atrocity Response Operations (MARO) Project at the Harvard Kennedy School of Government's Carr Center and a close adviser to Petraeus and Obama. Sewall was a member of the Obama Transition Team for national security and she served as the Deputy Assistant Secretary of Defense for Peacekeeping and Humanitarian Assistance in the Clinton administration. Along with Petraeus, Sewall wrote a foreword to the U.S. Army and Marine Corps Counterinsurgency Manual, released in 2007. Along with Sunstein, Power, U.S. ambassador to the UN Susan Rice, U.S. ambassador to Russia Michael McFaul, and chief Obama policy adviser Valerie Jarrett, Sewall is part of the "brain trust" running the covert White House computer hacking and information warfare team. After successfully engineering the toppling of the Ben Ali, Mubarak, Qaddafi, and Saleh regimes in Tunisia, Egypt, Libya, and Yemen, respectively, the team is now concentrating on regime changes in Syria, Iran, Cuba, Venezuela, Myanmar, Sudan, Algeria, Russia, and China. Conversely, the White House operation, using automatic "sock puppet" software among other tactics, is attempting to forestall the popular overthrow of unelected supranationally-installed austerity governments in Greece and Italy by spreading the meme that the Greek and Italian working class are lazy tax evaders who have been living off the public dole. In a March 29, 2011, e-mail, Stratfor's Sean Noonan wrote that Cohen was part of a State Department initiative in 2008 that saw the foundation of Movements.org and that this was part of a program initiated during the Bush administration to engage in "public diplomacy" over the Internet. The email cites the 21st Century Diplomacy and Civil Society 2.0 programs as being part of this initiative and that one of the first operations of the State Department team was to organize a worldwide protest against the Revolutionary Armed Forces of Colombia (FARC) in 2008. But where the Stratfor analysis was mistaken was its conclusion that Cohen's Movements.org had split with the U.S. government. If one defines the covert White House information operations team as separate from the U.S. government, Stratfor would be correct. However, the Sunstein/Power/Sewall/Rice/Jarrett/McFaul team has been officially sanctioned by President Obama, CIA director Petraeus, and Secretary of State Hillary Clinton. Even though Power referred to Mrs. Clinton as a "monster" during the 2008 presidential election campaign, this has not curbed Clinton's enthusiasm for using the "soft power" of Facebook, Twitter, NGOs, and propagandized Al Jazeera, Voice of America, and other media to bring about regime change in targeted countries. The Noonan email states that Cohen and Movements.org established cells across Cairo in support of the Egyptian April 6 Youth Movement. The White House covert information warfare program also enjoys the support of International Criminal Court chief prosecutor Louis Moreno Ocampo who is ensuring that officials of the United States and its allies are not accused of war crimes in fomenting and stoking the flames of internal rebellions. The Noonan email cites the role of two organizations funded by the CIA, used to mount and anti-government uprising in Serbia, and inspired by the Albert Einstein Institutions Gene Sharp, the architect of the current CIA blueprint for co-opted revolutions -- the Center for Applied NonViolent Action and Strategies (CANVAS) and OTPOR! The role of the 2008 State Department-sponsored Alliance for Youth Summit in New York in backing the future April 6 Youth Movement in Egypt is also referenced. The email also states that Otpor! lost much of its steam after the 2003 assassination of Otpor's favored leader, Serbian Prime Minister Zoran Dindic, in 2003. In a "not for publication" paragraph, the email states, "Serbia is exactly what we don't want to see"---Otpor needed a political leader and was able to create that, but Dindic was assassinated in 2003 and the momentum of Otpor has not been maintained afterwards." The Noonan email also states that Myanmar and Cuba are targets for Movements.org in organizing themed revolutions. The information corresponds to the information WMR received about the current priorities of the covert White House information operations group. Re: movements.org founder Cohen Email-ID 1113596 Date 2011-02-11 19:42:49 From burton@stratfor.com To bokhari@stratfor.com, scott.stewart@stratfor.com, secure@stratfor.com The dude is a loose canon. GOOGLE is trying to stop his entry into Gaza now because the dude is like scorched earth. Its unclear to GOOGLE if he's driving w/out a license, but GOOGLE believes he's on a specific mission of "regime change" on the part of leftest fools inside the WH who are using him for their agendas. I would hope the Shabak pick him up for "an interview". Re: [alpha] INSIGHT- US/MENA- Movements.org Email-ID 1140035 Date 2011-03-29 23:45:20 From burton@stratfor.com To alpha@stratfor.com List-Name alpha@stratfor.com From: Sean Noonan Sender: alpha-bounces@stratfor.com Date: Tue, 29 Mar 2011 16:17:19 -0500 (CDT) To: Alpha List ReplyTo: Alpha List Subject: Re: [alpha] INSIGHT- US/MENA- Movements.org He is a co-founder and board member. So he oversees the show, but isn't doing day-to-day work. On 3/29/11 4:12 PM, Bayless Parsley wrote: So what is Cohen's current ties with them? On 3/29/11 4:04 PM, Reginald Thompson wrote: SOURCE: n/a ATTRIBUTION: STRATFOR source SOURCE DESCRIPTION: Main organizer at movements.org PUBLICATION: Some is not for publication. Rest is background SOURCE RELIABILITY: ITEM CREDIBILITY: [in terms of knowing what movements.org is doing, they are A-1, but in terms of what the other groups are doing, source is not great] SPECIAL HANDLING: none SOURCE HANDLER: Sean My Notes: How Movements.org got started: [This part is not for publication] in 2008 it became apparent to the USG that they needed to do public diplomacy over the internet. So Jared Cohen was at DoS then and played a major role in starting the organization. The main goal was just spreading the good word about the US. Similar inititiaves have come aobut in 21st Century Diplomacy and Civil Society 2.0, but movments.org has since split from the US government. A key turning point in leading to its creates was seeing Oscar Morales organize a Global Day of Protest against FARC in 2008. This is the first time social networking was really used to organize a protest. [This part is not for publication] Three goals- Taking people wanting social change from the internet to constructive activism by: 1. monopolizing on initial success (this generally means getting popular on facebook) 2. Staying secure 3. Peer-to-peer training Currently choosing "Unlikely Leaders" to be invited to the next Global Summit. These are people that for example start a facebook activisit group that becomes very popular and then suddenly are completely unprepared--much like April 6 in Egypt. CANVAS will also be invited. Source is familiar with them, but has not been through their training. they are part of a network of NGOs ready to negotiate with Facebook when activist accounts are deleted or hacked. Movements.org wants a sort of Facebook customer service to be created just to deal with activism, since there are positives and negatives to allowing anonymous accounts, and those will probably never be allowed anyway. Movements.org is engaging with these groups once they actually get popular. This is the main criteria for their involvement, or inviting them to their Summits. Answer to the neutrality issue-- "we are by no means trying to overthrow governments." Movements.org goal is to develop civil society and social movements. [Not for Pub. And don't let this get back to RS501, for now] "Serbia is exactly what we don't want to see"---Otpor needed a political leader and was able to create that, but Dindic was assinated in 2003 and the momentum of Otpor has not been maintained afterwards. [Not for pub] The Internet is helpful in bring people together, but the hard part is keeping them together. The first real examples politically were the color revolutions and now MENA. But the challenge has been keeping the momentum going to keep these social movements alive. They were a case study in the power of technology for short-term political change, but that's it. Movements.org was communicating with someone at April 6 who said they had established different cells across Cairo in case one group was arrested. [not sure if we knew this] Egyptians are now presented with two choices--1. to find a political leader and take power or, 2. To create a sustainable social movement. Source sees this as a dichotomy. Manuel Castells is the only academic to have really examined the internet in terms of social networks. Agrees with S-weekly on Social media. The impetus for these revolutions is there already, social media is just tapping into that. MY THOUGHTS AND IMPRESSIONS First, to explain the thing about Serbia- the source is pretty set on trying to create these long-term sustainable social movements that are effective over various issues, rather than new political parties that take power. The criticism of OTPOR is interesting, and is telling about how Movements.org would like to work. I get the idea that this organization is actually farther behind then we are--understaffed and inexperienced. I don't mean this critically, because really no one is that experienced in online organization--they are breaking new ground. They have a pretty good understanding of the challenges presented by social media--and that is really what they are focusing on, but don't really have solutions yet. Their main response to this is to develop this peer-to-peer training done through people they designate as ambassadors to work with others in their own country or region. So really what Movements.org is doing right now is creating a database of training materials and valuable networks for groups to learn from each other--not doing direct training like CANVAS. They are also doing everything after things get started--waiting for these groups to get big, then trying to work with them. This means they aren't identifying countries or groups to start some shit in. Though, I get the impression they would like to be more active in th emore oppresive countries like Cuba and Myanmar. You can probably see how the idealism bleeds through.

|

|

|

|

Proof the Birth Certificate was created in Adobe Illustrator.

See Layers |

|

|

Mara Zebest,

Nationally recognized computer expert who has

written 10 books on advanced computer graphics says

the birth certificate is a forgery. Amazon.com Mara Zebest

|

|

|

Safety paper

and watermark issues.

Chromatic aberrations from scanning are missing. |

|

| A person skeptical that the birth certificate was forged opens the document and discovers the 'layers' and concludes its a fake. | |

| Kerning. The document presented by Obama contains kerning (adjusting the spacing between characters of a proportional font). This was not possible on a 1960's typewriter. | |

| Obama bagman is sent to jail over $3.5m payment by British tycoon |

|

Barack Obama

... Barack Obama says that he was

bone-headed to get involved with Antoin Rezko James

Bone in New York, Dominic Kennedy in London

TimesOnline Prosecutors motion for Tony Rezco's

arrest | <TimesOnline>

Mr Rezko's response <TimesOnline>

Mr Rezko's loan filing | <TimesOnline>

Sunday Times Rich List: Nadhmi Auchi ...

An undeclared $3.5 million (£1.8 million) payment

from a corrupt Iraqi-British businessman has landed

Barack Obama’s former fundraiser behind bars.

The payment, disclosed in court papers, is the first time that Mr Obama’s long-serving bagman Antoin “Tony” Rezko, a Syrian immigrant to the United States, has been linked to Nadhmi Auchi, the Iraqi-born billionaire who is one of Britain’s richest men. The relationship is a potential embarrassment for Mr Obama, who has made his opposition to the Iraq war a central plank of his campaign. Court papers describe Mr Rezko as a close friend of Mr Auchi. The two are involved in a large Chicago land development together. But it is unclear how long the two men have known each other or whether they were linked before the 2003 Iraq war. Neither side would discuss their relationship. The Times has, however, discovered state documents in Illinois recording that Fintrade Services, a Panamanian company, lent money to Mr Obama’s fundraiser in May 2005. Fintrade’s directors include Ibtisam Auchi, the name of Mr Auchi’s wife. Mr Auchi’s spokespeople declined to respond to a question about whether he was linked to this business. Mr Rezko, to be tried for corruption this month, had his bail revoked on Monday after he disobeyed a court’s instructions to keep it informed of changes to his finances. Prosecutors feared that he could try to flee abroad. The property developer has been condemned by Hillary Clinton as a “slum landlord”. According to prosecution documents Mr Rezko tried to persuade unnamed Illinois officials to help Mr Auchi to get a US visa after he was convicted of fraud in France. Mr Obama’s aides deny that he was approached. Mr Rezko has been indicted for pressuring companies seeking state business for kickbacks and campaign contributions, although none for Mr Obama. He was granted bail in October 2006. He told a judge that he had no access to overseas money. But in April 2007 Mr Auchi’s business, General Mediterranean Holding (GMH), wired $3.5 million to Mr Rezko from a bank account in Beirut via a law firm. The Chicago businessman has already been an embarrassment to Mr Obama’s campaign. The presidential challenger has tried to dampen criticism by paying $150,000 to charity to make up for donations from Mr Rezko. The Illinois senator has said that he made a “bone-headed mistake” to get involved in a property deal with Mr Rezko at a time when he was known to be under investigation. Mr Auchi has attracted attention at Westminster because of his closeness to politicians and the Establishment. He says that his brother was executed by Saddam Hussein’s regime. His business partners in Britain have included Lord Steel of Aikwood, the former Liberal leader, and Keith Vaz, the Labour MP and Home Affairs Committee chairman. On the 20th anniversary of his business in 1999, Mr Auchi received a greeting card signed by 130 politicians, including Tony Blair, William Hague and Charles Kennedy, who were then leaders of their respective parties. Norman Lamb, the Liberal Democrat MP, went on to table parliamentary questions asking why the Blair Government appeared slow to respond to a French extradition request. Mr Lamb said last night: “It’s a matter of public interest to understand why the payments were made. This deserves thorough investigation.” Mr Auchi founded GMH in 1979, a year before he left Iraq. He says that he did business with his native country when it was considered a friend of the West but ceased to trade with Saddam’s regime once sanctions were imposed after the invasion of Kuwait. US prosecution documents recall Mr Auchi’s suspended jail sentence and €2 million fine for corruption in France five years ago. Defence lawyers said that Mr Auchi lent the $3.5 million for legal and family expenses. Most of the money had gone directly to law firms and there had been no attempt to flee. “While the Government attempts to besmirch Mr Auchi’s character,” they said, “he is one of Britain’s wealthiest men, has been a guest at the White House and met with two of the last three presidents, was Co-Chair of the Kennedy School of Government at Harvard, is President of the Anglo-Arab Organisation, and has received numerous awards and honorary positions from heads of state, including Queen Elizabeth II, Pope John Paul II, and King Abdullah II of Jordan.” Mr Auchi’s lawyers added: “Mr Auchi flatly and categorically denies any wrongdoing in relation to the matters that led to his conviction in France and he is pursuing an appeal against it.” Mr Auchi is also suing the oil company Elf in France for dragging him unwittingly into the scandal.

|

|

Spring 2004:

Nadhmi Auchi visits Illinois and Michigan, attending

an event at Four Seasons Hotel in Chicago. Senator

Obama shakes hands with Middle East businessmen at

event at Four Seasons in Chicago, but aides say he

does not remember Mr Auchi

2004: Mr Auchi makes first investment in 62-acre land development project Riverside Park in Chicago, according to Mr Rezko's lawyer. June 16, 2004: AR Pizza established in Delaware. Mr Auchi is "passive investor" in the company April 28 2005: Mr Auchi's conglomerate General Mediterranean Holding (GMH) lends $3.5 million to Tony Rezko May 23 2005: Fintrade Services SA, a Panamanian company related to Mr Auchi, registers loan to Mr Rezko, secured by Mr Rezko's stake in AR Pizza June 15 2005: Mr Rezko's wife Rita buys garden plot on same day as Obamas buy neighbouring mock Georgian mansion from same seller. Mrs Rezko pays asking price of $625,000, with a $500,000 mortgage. Obamas pay $1.65 million, which is $300,000 less than the asking price September 30 2005: GMH makes $11 million loan to Mr Rezko November 2005: Mr Rezko lobbies US State Department and, apparently, elected officials to try to get a US visa for Mr Auchi, prosecutors say December 7 2005: AR Pizza sued by Papa John's pizzeria chain from: http://www.timesonline.co.uk/tol/news/world/us_and_americas/us_elections/article3433363.ece

|

| SUNDAY, SEPTEMBER 12, 2004

Times Online - Newspaper Edition Iraqi billionaire bids to take Leeds back to football big time David Leppard and Robert Winnett A CONTROVERSIAL Iraqi billionaire is preparing to buy the ailing Leeds United football club in an attempt to restore it to its former glory. Nadhmi Auchi, a British-based businessman with a fortune claimed to be worth £1.3 billion, is drawing up detailed plans to take control of the debt-ridden club. He hopes to move it to a purpose-built stadium, redeveloping the current Elland Road ground to pump millions into the Coca-Cola Championship side. Yesterday, sources close to Auchi confirmed he was interested in buying the club. One said: “This is one of the most important clubs in the country and Auchi believes he can help the supporters and the local community but still make a profit. Everything now depends on the price.” A former Ba’ath party member whose brothers were killed by Saddam Hussein’s regime, Auchi left Iraq in the late 1970s to settle in London. He is one of Britain’s wealthiest and best connected citizens, yet maintains a low profile. Lord Lamont, a former Tory chancellor, sits on the board of Auchi’s holding company and the billionaire hosts regular dinners attended by royals, Middle Eastern leaders and MPs. He has also bought tables at Labour fundraising dinners. He has quietly built a business empire comprising 120 firms across the world in property, construction and hotels. However, his business dealings have often proved controversial. Last year, in France, he was convicted of paying kickbacks to the oil firm Elf. Auchi, who was born in Baghdad in 1937, received a 15- month suspended jail sentence and a £1.39m fine. He says the prosecution was politically motivated and is appealing against it. In Britain, a pharmaceutical firm he owns is co-operating in a criminal investigation by the Serious Fraud Office into an alleged price-fixing cartel involving supplies for the National Health Service. Auchi’s interest in Leeds is believed to have begun this year when it was about to be relegated from the Premiership after a financial meltdown. Leeds United was once one of Britain’s most successful football clubs. During its heyday in the 1960s and 1970s, its star players included legends such as Billy Bremner, Jack Charlton and Norman Hunter. However, the club’s fortunes took a disastrous turn in the 1990s when it invested heavily in players without succeeding on the pitch. It was rescued from administration last February by local businessmen. However, the club was relegated and is languishing in the bottom half of the Championship with estimated debts of £40m. Auchi is thought to have drawn up a 10-year business plan for Leeds. It involves moving the club and redeveloping the Elland Road ground with flats, shops and community facilities. The ground lies in an attractive area for property developers — close to motorways — and this is thought to have sparked Auchi’s interest. This weekend Auchi was unavailable for comment but a friend said: “This will be a big redevelopment. He wants to help the community, help a very old established football club and make some money. He wants to be seen to be investing in England and creating jobs.”

|

| NADHMI AUCHI is a member of an

elite club known as Le Cercle. It consists of

transatlantic businessmen and politicians and is

often compared with the Bilderberg Group. The

secretive group of 100 people meets twice a year to

discuss global politics and business. The next

meeting is scheduled to be held in Washington this

month.

The club, which has close links to the intelligence services, was founded in the 1950s by former French prime minister Antoine Pinay and former German chancellor Konrad Adenauer. Guests at the club's meetings have included Richard Nixon, Henry Kissinger, the Sultan of Oman, Romania's Ion Illiescu and King Hussein of Jordan. The current chairman is Lord Lamont, the former Tory chancellor, and other members are thought to include Anthony Cavendish and Geoffrey Tantum, who are both former MI6 officers. |

| WSWS Total oil in France’s biggest postwar financial scandal By Keith Lee 11 July 2003 While oil companies are scrambling to take advantage of the vast profits to be made from the plunder of the Iraqi oil industry, one of those bidding for contracts—Total formerly known as TotalFinaElf—is currently involved in a court case in France that has exposed corruption on a vast scale that goes to the highest levels of the state. It has been called France’s biggest postwar financial scandal. TotalFinaElf was awarded the rights to 2 million barrels of Iraqi oil as the US administration tried to allay fears that contracts would only be given to US and British companies. The investigation into corruption at TotalFinaElf has been going on for eight years. Magistrates have filed a report that names close to 40 executives, politicians and middlemen that were part of a network that took nearly three billion francs in kickbacks from Elf in the early 1990s. The case, which is set to conclude in the next two months, has so far used the services of over 80 lawyers. Investigative judge Eva Joly, who presided over the case in 1994, has written a book on the trial since her retirement last year. In extracts published in the French press she speaks of the case being hampered by government resistance, claims she received death threats and is now protected by bodyguards around the clock. The book, which was due out June 19, was the subject of a temporary ban until July 7 when the defence were due to present their closing statements in the trial. The book, “Is this the world we want to live in?”, argues that France is institutionally corrupt. Total originated as Elf Aquitaine, founded by General De Gaulle. Elf Aquitaine was privatised in 1994 and merged into TotalFinaElf. It has routinely served as a cover for secret French governmental operations, which included the bribing of African leaders and money laundering in Latin America. Elf’s activities in Africa were organised in the 1950s by President Charles de Gaulle and his adviser, the late Jacques Foccart. It used a series of networks as a way of accumulating oil wealth, via Elf, from newly independent colonies in West Africa. Elf used a system of split commissions as a way of maintaining French influence and later subsidising Gaullist political activities. This work was carried on by Charles Pasqua, 74, a Gaullist who was twice interior minister. Evidence presented in the court case showed that he used Elf corporate planes on more than 70 occasions. It has been alleged that the trips were for political and personal reasons. The free travel was said to have been organised by an Elf adviser named Andre Guelfi. Guelfi has far reaching global business connections, largely through contacts he made as an intermediary for the International Olympic Committee. This activity was so frequent that it came to be dubbed “Air Elf”. The court case has exposed the link between the top levels of the French state and a shadowy network of middlemen, outright crooks and corrupt businessmen. Elf former Chief Executive Loik Le Floch-Prigent has been accused of using company money to pay his divorce settlement, with the permission of the late French President Francois Mitterrand. Le Floch-Prigent was convicted in 2001 in an earlier trial. That case also brought convictions in May 2001 for Roland Dumas, France’s former foreign minister, who was jailed for six months for receiving illegal funds from Elf from 1989-1992. The political ramifications of the case have gone beyond the borders of France. In 2001 a prosecution was instigated by the Spanish Supreme court against the former foreign minister, Josep Pique, over alleged financial irregularities. The investigation related to the sale of a Spanish company Ertoil to Elf in 1991. Pique was a high-ranking executive at Ertoil. The Supreme court voted 10-2 in favour of charging Pique with suspicion of misappropriation of funds, tax evasion and fraud. The $206 million from the sale to Elf was channelled into a holding company in Luxembourg. The investigation committee has not been able to trace where over half the money has gone. The sale of Ertoil to Elf has formed a substantial part of the court case. Recently the person who brokered the Spanish deal, Nadhmi Auchi, gave evidence to the court. The French authorities in a statement published by Channel Four News said, “He has been charged on the warrant with three charges of conspiracy to defraud involving the takeover of Ertoil by General Mediterranean Holdings (GMH) [Auchi’s arms company] and its subsequent sale to Elf between December 1990 and August 1994.” Auchi is an Iraqi-born British businessman who has recently been extradited to France from Britain. It has taken the French authorities nearly two years to get the extradition as it was blocked by the Blair government. While in Britain Auchi developed some very powerful friends. Former Conservative Chancellor Lord Lamont was chosen to serve on the board of his Luxembourg banking company Cipaf and former Liberal Party leader Lord David Steel agreed to take up a directorship in Auchi’s arms company General Mediterranean Holdings. Auchi also developed a close relationship with the present Labour government. On the 20th anniversary of GMH’s founding he was presented with an oil painting of parliament by the billionaire Lord Sainsbury on behalf of the Prime Minister Tony Blair. The painting was signed by 100 MPs, including former Conservative Party leader William Hague and Liberal Democrat leader Charles Kennedy. He used his newfound friends in the Labour Party to hire Keith Vaz MP as a director of GMH. Although Vaz resigned once he became a minister he still kept in contact with Auchi. As Europe Minister Vaz made enquiries on his behalf over the French extradition warrant. Auchi is Britain’s seventh richest man. He was formally a member of the Baathist party and a close confidant of Saddam Hussein. Auchi was tried alongside Hussein for his involvement in the conspiracy to assassinate the Iraqi Prime minister in the 1950s. He made his money using his influence with the Baathist regime to establish a banking empire in Britain and Luxembourg in the early 1980s. In 1987, he had been involved for four years with one of Italy’s most controversial bankers, Pierfrancesco Pacini Battaglia. Together they were exposed in Italy’s “Clean Hands” investigation into financial corruption. The investigation showed that when Saddam Hussein sought to construct a giant pipeline from Iraq to Saudi Arabia in 1987 it was one of the most lucrative projects in the world. The Italian-French joint venture used Auchi and Battaglia to secure the contract. In his confession Battaglia said Auchi was used to pay bribes to the Iraqi government to deal with the Italians. According to the April 6 Observer newspaper in Britain Battaglia said, “To acquire the contract it was necessary, as is usual, especially in Middle Eastern countries, to pay commission to characters close to the Iraqi government... In this case, the international intermediary who dealt with this matter was the Iraqi Nadhmi Auchi.” Once in court Battaglia told how he paid millions of pounds in kickbacks to French oil executives. He said this was standard practice at Elf and was claimed to have been told by Elf Executives, “What was good for Elf was good for France.” While Auchi made millions out of this deal it was nothing compared to his money made in the sale of a Kuwaiti-owned oil field in Spain, which is at the heart of the ongoing court case. At the time of Saddam Hussein’s invasion of Kuwait in 1991, its government decided to sell one of its oil refineries in Spain to raise extra cash. When red tape in Europe impeded the sale, the Kuwaitis decided to speed things up using Auchi as an intermediary. It has been alleged that for the deal, secret commission payments were made to Auchi. French investigators believe that a substantial proportion of the payments from Elf-Aquitaine found their way back into the pockets of senior executives, one such being Alfred Sirven who organised the deal. It appeared to the investigators that “kickbacks” were being made and that this “web of corruption” involving the French oil company went to the heart of the French government. Investigators think that Auchi got a total of 5.6 billion pesetas for organising the deal for Elf and siphoned off 2.4 billion to Sirven to be put into a secret account at Auchi’s bank in Luxembourg. Auchi has protested his innocence and has always claimed that the money received in the Ertoil refinery deal was a legitimate commission. The scandal provides some insight into the corrupt world of the transnational oil corporations and their political representatives in whose interests innocent men, women and children are slaughtered in Iraq and elsewhere. |

| America in Jeopardy on Dr. Carroll Quigley back |

| Georgetown University professor, Dr. Carroll Quigley, because of the secrecy surrounding Rhodes dealings, it cannot be verified. Dr. Quigley named the following as being included as key players or Initiates with Rhodes: Nathan Rothschild, Baron Rothschild; Sir Harry Johnston; William T. Stead; Reginal Brett; Viscount Esher; and Alfred Milner, Viscount Milner; Alfred Beit; Archibald Primrose, Earl of Rosebery; Arthur James Balfour; Lionel Curtis; Viscount Waldorf Astor and Lady Astor. The Association of Helpers or the Inner Circle included: Philip Kerr, Marquess of Lothian; Lionel Curtis; Jan Smuts; and Arnold Toynbee; The Outer Circle included: Robert Cecil, Viscount Cecil of Chelwood and Isaiah Berlin (Quigley, The Anglo-American Establishment, 311-313).After the death of Rhodes, Lord Rothschild, Alfred Beit, and Stead carried out the plans in his seven wills, which includes the Rhodes Scholarship program. According to Dr. Carroll Quigley who wrote from an insiders point of view in his book, Tragedy and Hope,In 1891, Rhodes organized a secret society with members in a 'Circle of Initiates' and an outer circle known as the 'Association of Helpers' later organized as the Round Table organization. In 1909- 1913, they organized semi-secret groups known as Round Table Groups in the chief British dependencies and the United States. The Round Table Groups were semi-secret discussion and lobbying groups whose original purpose was to federate the English speaking world along lines laid down by Cecil Rhodes. In 1915, Round Table groups existed in England, South Africa, Canada, Australia, New Zealand, India, and the United States. Money for their activities originally came from Cecil Rhodes, J. P. Morgan, the Rockefeller and Whitney families, and associates of bankers Lazard Brothers and Morgan, Grenfell and Company. In New York, it was known as the Council on Foreign Relations and was a front for J.P. Morgan and Company, in association with the very small American Round Table Group.Quigley also wrote,There does exist and has existed for a generation, an international Anglophile network which operates to some extent in the way the Radical Right believes the Communists act. In fact, this network, which we may identify as the Round Table Groups, has no aversion to cooperating with the Communists, or any other groups, and frequently does so.According to one expert on the dream of Cecil Rhodes', the U.S. Roundtable Group, known as the Council on Foreign Relations-CFR is the equivalent of the British Royal Institute for International Affairs, now known as Chatham House. Another group is the Pilgrims Society of which Queen Elizabeth II is the patron. There are other related groups. Many of the people who are members of one group are also members of other related groups. President Bill Clinton was our first Rhodes Scholar president and he, along with most of our presidents, and key officials, throughout the present and past administrations, are members of the CFR.In several previous newsletters on oil, I discussed the role of President Nixon and Henry Kissinger's National Strategic Study Memorandum 200, as well as, the role of the Council on Foreign Relations with regard to keeping third world countries backward, so they would not need their own oil resources for industry or manufacturing plants. The old adage, "He who owns the gold, makes the rules" will always be true. If gold were not important or valuable, Rhodes would not have waged vicious wars over it. The same is true for diamonds. When will gold lose its shine? When diamonds lose theirs. |

| Trilateral members back |

| Madeleine K. Albright, Principal, The Albright

Group LLC, Washington, DC; former U.S. Secretary of

State Graham Allison, Director, Belfer Center for

Science and International Affairs, Harvard

University, Cambridge, MA G. Allen Andreas, Chairman

and Chief Executive Officer, Archer Daniels Midland

Company, Decatur, IL Michael H. Armacost, President,

The Brookings Institution, Washington, DC; former

U.S. Ambassador to Japan; former U.S. Under

Secretary of State for Political Affairs C. Michael

Armstrong, Chairman and Chief Executive Officer,

AT&T, New York D. Euan Baird, Chairman of the Board,

President and Chief Executive Officer, Schlumberger

Limited, New York Charlene Barshefsky, Senior

International Partner. Wilmer, Cutler & Pickering,

Washington, DC; former U.S. Trade Representative C.

Fred Bergsten*, Director, Institute for

International Economics, Washington, DC; former U.S.

Assistant Secretary of the Treasury for

International Affairs Susan V. Berresford,

President, The Ford Foundation, New York Lord Black

of Crossharbour, Chairman of the Board and Chief

Executive Officer, Hollinger International, Inc. and

Hollinger Canadian Publishing Holdings, Inc.

Geoffrey T. Boisi, Vice Chairman, JPMorgan Chase,

New York; Co-Chief Executive Officer, JPMorgan

Stephen W. Bosworth, Dean, Fletcher School of Law

and Diplomacy, Tufts University, Medford, MA; former

U.S. Ambassador to the Republic of Korea Harold

Brown, Counselor, Center for Strategic and

International Studies, Washington, DC; General

Partner, Warburg Pincus & Company, New York; former

U.S. Secretary of Defense John H. Bryan, Chairman,

Sara Lee Corporation, Chicago, IL Zbigniew

Brzezinski*, Counselor, Center for Strategic and

International Studies, Washington, DC; Robert Osgood

Professor of American Foreign Affairs, Paul Nitze

School of Advanced International Studies, Johns

Hopkins University; former Assistant to the

President for National Security Affairs Gerhard

Casper, President Emeritus, Stanford University,

Stanford, CA William T. Coleman, Jr., Senior Partner

and Senior Counselor, O’Melveny & Myers, Washington,

D.C.; former U.S. Secretary of Transportation

William T. Coleman III, Chairman and Chief Executive

Officer, BEA Systems, Inc., San Jose, CA Timothy C.

Collins, Chief Executive Officer, Ripplewood

Holdings, New York Richard N. Cooper, Maurits C.

Boas Professor of International Economics, Harvard

University, Cambridge, MA; former Chairman, National

Intelligence Council; former U.S. Under Secretary of

State for Economic Affairs E. Gerald Corrigan,

Managing Director, Goldman, Sachs & Co., New York;

former President, Federal Reserve Bank of New York

Michael J. Critelli, Chairman and Chief Executive

Officer, Pitney Bowes Inc., Stamford, CT Douglas

Daft, Chairman and Chief Executive Officer, The Coca

Cola Company, Atlanta, GA Dennis D. Dammerman, Vice

Chairman and Executive Officer, General Electric

Company, Fairfield, CT Lodewijk J. R. de Vink,

Chairman, Global Health Care Partners, Peapack, NJ;

former Chairman, President, and Chief Executive

Officer, Warner-Lambert Company André Desmarais,

President and Co-Chief Executive Officer, Power

Corporation of Canada, Montréal; Deputy Chairman,

Power Financial Corporation John M. Deutch,

Institute Professor, Massachusetts Institute of

Technology, Cambridge, MA; former Director of

Central Intelligence; former U.S. Deputy Secretary

of Defense Peter C. Dobell, Founding Director,

Parliamentary Centre, Ottawa Wendy K. Dobson,

Professor and Director, Institute for International

Business, Rotman School of Management, University of

Toronto; former Associate Deputy Minister of Finance

Jessica P. Einhorn*, Consultant, Clark and Weinstock,

Washington, D.C.; former Managing Director for

Finance and Resource Mobilization, World Bank

Jeffrey Epstein, President, J. Epstein & Company,

Inc., New York; President, N.A. Property Inc.

William T. Esrey, Chairman and Chief Executive

Officer, Sprint Corporation, Kansas City, MO Dianne

Feinstein, Member (D-CA), U.S. Senate Sandra

Feldman, President, American Federation of Teachers,

Washington, D.C. Martin S. Feldstein, George F.

Baker Professor of Economics, Harvard University,

Cambridge, MA; President and Chief Executive

Officer, National Bureau of Economic Research;

former Chairman, President’s Council of Economic

Advisors Stanley Fischer, Vice President, Citigroup,

Inc., New York; former First Deputy Managing

Director, International Monetary Fund, Washington,

DC Richard W. Fisher, Managing Partner, Fisher

Family Fund LP, Washington, DC; former U.S. Deputy

Trade Representative Thomas S. Foley*, Partner,

Akin, Gump, Strauss, Hauer & Feld, Washington, DC;

former U.S. Ambassador to Japan; former Speaker of

the U.S. House of Representatives: North American

Chairman, The Trilateral Commission L. Yves

Fortier*, Senior Partner and Chairman, Ogilvy

Renault, Barristers and Solicitors, Montréal; former

Canadian Ambassador and Permanent Representative to

the United Nations Stephen Friedman, Senior

Principal, MMC Capital, Inc., New York; former

Chairman, Goldman, Sachs & Co. Richard N. Gardner,

Professor of Law and International Organization,

Columbia Law School, New York; Of Counsel, Morgan,

Lewis & Bockius LLP; former U.S. Ambassador to Italy

and to Spain David Gergen, Public Service Professor

of Public Leadership, John F. Kennedy School of

Government, Harvard University, Cambridge, MA;

Editor-at-Large, U.S. News and World Report,

Washington, DC Louis V. Gerstner, Jr., Chairman and

Chief Executive Officer, International Business

Machines, Armonk, NY Peter C. Godsoe, Chairman and

Chief Executive Officer, The Bank of Nova Scotia,

Toronto Allan E. Gotlieb*, Senior Consultant,

Stikeman Elliott, Toronto; Chairman, Sotheby’s,

Canada; former Canadian Ambassador to the United

States; North American Deputy Chairman, The

Trilateral Commission Jeffrey W. Greenberg, Chairman

and Chief Executive Officer, Marsh & McLennan

Companies, New York Maurice R. Greenberg, Chairman

and Chief Executive Officer, American International

Group, Inc.,New York Robert D. Haas*, Chairman, Levi

Strauss & Co., San Francisco, CA William A.

Haseltine, Chairman and Chief Executive Officer,

Human Genome Sciences, Inc., Rockville, MD Charles

B. Heck, Former North American Director, The

Trilateral Commission, New Canaan, CT Carla A.

Hills*, Chairman and Chief Executive Officer, Hills

& Company, Washington, DC; former U.S. Trade

Representative; former U.S. Secretary of Housing and

Urban Development Richard Holbrooke, Vice Chairman,

Perseus LLC, New York; Counselor, Council on Foreign

Relations; former U.S. Ambassador to the United

Nations; former Vice Chairman of Credit Suisse First

Boston Corporation; former U.S. Assistant Secretary

of State for European and Canadian Affairs, and for

East Asian and Pacific Affairs; former U.S.

Ambassador to Germany James R. Houghton, former

Chairman and Chief Executive Officer, Corning Inc.,

Corning, NY James A. Johnson, Vice Chairman, Perseus

LLC, Washington, DC; former Chairman and Chief

Executive Officer, Federal National Mortgage

Association (Fannie Mae) Alejandro Junco de la Vega,

Publisher, El Sol, El Norte, and Reforma, Mexico

Henry A. Kissinger, Chairman, Kissinger Associates,

Inc., New York; former U.S. Secretary of State;

former U.S. Assistant to the President for National

Security Affairs Jacques Lamarre, President and

Chief Executive Officer, SNC-Lavalin, Montreal

Kenneth L. Lay, Lay Interests, LLC, Houston, TX;

former Chairman and Chief Executive Officer, Enron

Corporation Jim Leach, Member (R-1st IA), U.S. House

of Representatives, Gerald M. Levin, Chief Executive

Officer, AOL Time Warner, Inc., New York Winston

Lord, Chairman, International Rescue Committee, New

York; former U.S. Assistant Secretary of State for

East Asian and Pacific Affairs; former U.S.

Ambassador to China E. Peter Lougheed, Senior

Partner, Bennett Jones, Barristers & Solicitors,

Calgary; former Premier of Alberta Roy MacLaren,

Former Canadian High Commissioner,Toronto; former

Canadian Minister of International Trade Whitney

MacMillan, Chairman Emeritus, Cargill, Inc.,

Minneapolis, MN Antonio Madero, Presidente Ejecutivo

del Consejo, San Luis Corporacion, S.A. de C.V.,

Mexico City Jessica T. Mathews, President, Carnegie

Endowment for International Peace, Washington, DC

Sir Deryck C. Maughan*, Vice Chairman, Citigroup,

New York; former Chairman and Chief Executive

Officer, Salomon Brothers Inc. Jay Mazur, President

Emeritus, Union of Needletrades, Industrial and

Textile Employees (UNITE), AFL-CIO, New York; Vice

President, AFL-CIO and Chairman, AFL-CIO

International Affairs Committee H. Harrison McCain,

Chairman of the Board, McCain Foods Limited,

Florenceville, New Brunswick Hugh L. McColl, Jr.,

Chairman and Chief Executive Officer, Bank of

America Corporation, Charlotte, NC William J.

McDonough*, President, Federal Reserve Bank of New

York Henry A. McKinnell, President and Chief

Executive Officer, Pfizer, Inc., New York Lucio A.

Noto, former Vice Chairman, ExxonMobil Corporation;

former Chairman of the Board and Chief Executive

Officer, Mobil Corporation; Greenwich, CT Joseph S.

Nye, Jr.*, Dean, John F. Kennedy School of

Government, Harvard University, Cambridge, MA;

former U.S. Assistant Secretary of Defense for

International Security Affairs Richard N. Perle,

Chairman, Defense Policy Boad, U.S. Department of

Defense; Resident Fellow, American Enterprise

Institute, Washington, DC; William J. Perry, Michael

and Barbara Berberian Professor, Stanford

University, Stanford, CA; former U.S. Secretary of

Defense Franklin D. Raines, Chairman and Chief

Executive Officer, Federal National Mortgage

Association, Washington, DC; former Director, Office

of Management and Budget, Office of the U.S.

President Charles B. Rangel, Member (D-15th NY),

U.S. House of Representatives Lee R. Raymond,

Chairman and Chief Executive Officer, ExxonMobil

Corporation, Irving, TX Hartley Richardson,

President and Chief Executive Officer, James

Richardson & Sons, Ltd., Winnipeg Charles S. Robb,

Fellow, Harvard University; former Member, U.S.

Senate; McLean, VA William V. Roth, Jr., former

Member, U.S. Senate; Wilmington, DE John D.

Rockefeller IV, Member , U.S. Senate David M.

Rubenstein, Managing Director, The Carlyle Group,

Washington, DC Luis Rubio, Director-General, Center

of Research for Development (CIDAC), Mexico City

George F. Russell, Jr., Chairman, Sunshine

Management Services, LLC, Gig Harbor, WA Arthur F.

Ryan, Chairman, President and Chief Executive

Officer, The Prudential Insurance Co. of America,

Newark, NJ Henry B. Schacht, Chairman, Lucent

Technologies, Murray Hill, NJ; former Director and

Senior Advisor, E.M Warburg, Pincus & Co., LLP

Raymond G.H. Seitz, Vice Chairman, Europe, Lehman

Brothers International, London; former U.S.

Ambassador to the United Kingdom Jaime Serra, SAI

Derecho & Economia, Mexico City; former Mexican

Minister of Trade Gordon Smith, Director, Centre for

Global Studies, University of Victoria, British

Columbia; Chairman, Board of Governors,

International Development Research Centre; former

Deputy Minister of Foreign Affairs of Canada and

Personal Representative of the Prime Minister to the

Economic Summit George Soros, Chairman, Soros Fund

Management LLC, New York; Chairman, The Open Society

Institute Ronald D. Southern, Chairman and Chief

Executive Officer, ATCO Group, Calgary Lawrence H.

Summers, President, Harvard University, Cambridge,

MA; former U. S. Secretary of the Treasury Strobe

Talbott, Director, Yale Center for the Study of

Globalization, New Haven, CT; former U. S. Deputy

Secretary of State Luis Tellez, Executive Vice

President, Sociedad de Fomento Industrial (DESC),

Mexico City; former Minister of Energy, Mexico John

Thain, President and Co-Chief Operating Officer,

Goldman Sachs & Co., New York G. Richard Thoman,

Senior Advisor, Evercore Partners, Stamford, CT;

former President and Chief Executive Officer, Xerox

Corporation; Laura D’Andrea Tyson, Dean of London

Business School, London; former Dean, Haas School of

Business, University of California, Berkeley; former

Head, National Economic Council; former Chairman of

the President’s Council of Economic Advisers. Paul

A. Volcker*, former Chairman, Wolfensohn & Co.,

Inc., New York; Frederick H. Schultz Professor

Emeritus, International Economic Policy, Princeton

University; former Chairman, Board of Governors,

U.S. Federal Reserve System; Honorary North American

Chairman and former North American Chairman, The

Trilateral Commission Glenn E. Watts, President

Emeritus, Communication Workers of America, Chevy

Chase, MD Lorenzo H. Zambrano*, Chairman of the

Board and Chief Executive Officer, CEMEX, Monterrey,

NL, Mexico; North American Deputy Chairman, The

Trilateral Commission Ernesto Zedillo, former

President of Mexico, Mexico City Mortimer B.

Zuckerman, Chairman and Co-Founder of Boston

Properties; Chairman and Editor-in-Chief, U.S. News

& World Report, New York

Robert S. McNamara, Lifetime Trustee, The Trilateral Commission, Washington, DC; former President, WorldBank; former U.S. Secretary of Defense; former President, Ford Motor Company. David Rockefeller, Founder, Honorary Chairman, and Lifetime Trustee, The Trilateral Commission, New York *Executive Committee Former Members In Public Service Richard B. Cheney, Vice President of the United States Paula J. Dobriansky, U.S. Under Secretary of State for Global Affairs Bill Graham, Minister of Foreign Affairs and International Trade, Canada Richard N. Haass, Director, Policy Planning Staff, U.S. Department of State Paul Wolfowitz, U.S. Deputy Secretary of Defense Robert B. Zoellick, U.S. Trade Representati

|

| Zoominfo Alfred Hartmann |

| Dr. Alfred

Hartmann Share This Profile Research Alfred Hartmann

at Intelius.com

25 Total References Web References James B. Nicholson, Trustee vs. Harmon - Witness John McCain www.kycbs.net, 22 Oct 2008 [cached] Gokal introduced Keating to Alfred Hartmann, a BCCI director and president of the Bank's Geneva branch. ... Steven Pizzo reported in the NATIONAL MORTGAGE NEWS that Hartmann provided $3 billionin loans to Saddam Hussein for nuclear, chemical and ballistic missile programs just preceding the Gulf war and is the director most closely linked to the laundering of Medullin Cartel drug money. ... In 1986, Keating, Hartmann and other BCCI directors met in London, Paris, Zurich, Phoenix and the Bahamas where they founded a corporation known as TRENDINVEST. The British, Muslim Terrorism and September 11 www.redmoonrising.com [cached] After the BCCI took over this bank it installed Alfred Hartmann as manager. Hartmann then became the chief financial officer for BCC Holding and thus one of BCCI's most influential directors. Hartmann was a member of the British banking establishment through his connections with the Rothschild family, being a member of the board of directors of N.M. Rothschild and Sons, London, and president of Rothschild Bank AG of Zurich. (4) progressive era » 2009 » July progressiveera.start4all.com, 16 July 2009 [cached] July 9, 2009 Al, The Villages, Fl writes: Roger S is demand. most of all I forced to authorize to in, when it comes to the renewable or unripened vivacity, my counterbalance is to command what vivacity? most of all Although there are some favourable things that could be done with renewable force, most reports that I cause scanned talk source to force outputs that at one's desire not beneath any condition reach the levels of power start that can power a notable entity. most of all When VP Biden said they misread the conciseness, he actually meant to command they misread description. most of all We at one's desire invest a stacks of loaded on body of laws projects but not more any nationalistic mixture. ... Alfred Hartmann, a bizarre Swiss banker who was also an administrator of the Bank of Credit and Commerce International (BCCI). Hartmann also was president of the Swiss Chemical Manufacturer's Society. In 1989 the U.S. Sto-ries in the Swiss compress cite Hartmann in 1986 complaining that sales of Swiss chemical producers was MO down and that hip markets had to be developed. George Soros and the Rothschild Connection privacynfreedom.homelinux.org, 9 May 2007 [cached] was Dr. Alfred Hartmann, the managing director of the Swiss branch of the BCCI (Banquede Commerce et de Placement SA), head of the Zurich Rothschild bank AG and member of the board of N.M. Rothschild & Sons in London.He was also on the board of the Swiss branch of the Bruce Rappaport, Alfred ... ampedstatus.com, 14 Oct 2001 [cached] Bruce Rappaport, Alfred Hartmann, and BCCI ... BCCI and BNL shared a key figure in common, Alfred Hartmann, who was on the board of directors of both banks and the head of BCCI's secretly controlled Swiss affiliate, Banque de Commerce et Placements (BCP).

|

| The Mysterious BNL Affair By Stephen Pizzo, http://www.stephen.pizzo.com OpEdNews |